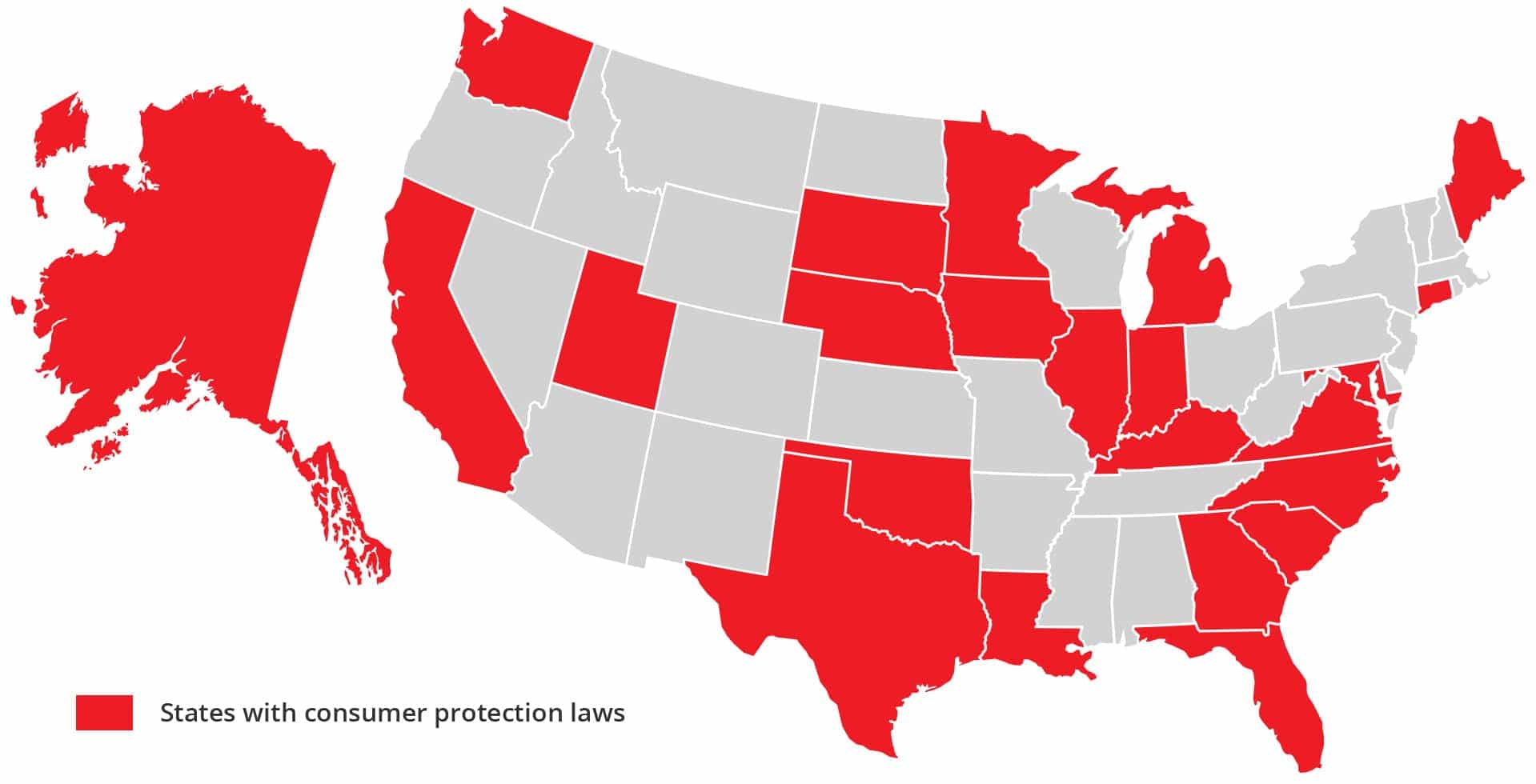

In the last two years three companies have been forced out of the healthy vending industry due to fraudulent business practices. These companies left scores of purchasers with no equipment, no support and no money back. None of these companies were following the laws in the 23 states and consumers could have found this out if they had been armed with the information on this page.

These three companies were not new. Two had been in business for several years and one for six years. The common denominator with all three was that they tried to expand their services into being a business opportunity but did not follow business opportunity law. Once a state discovered this they fined the company and forced them to return money. Once their cash on hand was gone they had no money left to refund other purchasers once other states learned of the illegal sales.

These same types of laws and business failures are also seen in the franchise world but prospective franchisees seem to be better informed of the laws companies must follow.

All 23 states require the seller to provide a detailed disclosure document to the prospective purchaser. It must include items like:

- Whether the company owners have been convicted of a felony or have declared bankruptcy

- How long the company has been in business and how long it has been offering the business opportunity

- If they offered a business opportunity in the past and if so why they stopped doing so

- What is included in the company’s training program

Seventeen of the 23 states require that the company register with a state government agency. These states have the best consumer protection. The phone number of the agency is listed so that you can call and verify whether a company is registered and selling legally to residents of that state.

Some states require that financial documents be included. Prospective purchasers often want to see how much money a company has in the bank as one measure of their financial stability. Cash of less than $250,000 is considered risky.

Many states require that equipment be delivered within 30-45 days. This prevents a company from offering to store the equipment for many months and then going out of business before it is delivered.

If your state is one of the 23 with a business opportunity law see if the company provides a detailed disclosure document at the beginning of the sales process. If they do not they are not following the law. If they do check your state on this page to see if registration is required. If it is call your state and ask if they are registered.

Ask the company if they follow business opportunity law. If they do they will be happy to discuss their compliance with you. If they provide excuses instead of a disclosure you may want to consider other options.

Remember–if a company says they will help you start a business they are a business opportunity and fall under these laws.